Absolutely. Many first home buyers stay at home longer to save — but that can create a challenge when it comes time to apply for a loan.

Some lenders prefer to see rental history (also called a rental ledger) as proof you can manage regular payments. But:

Here’s how we help first home buyers demonstrate they can manage loan repayments even if they’ve never rented:

Bank Statement History

Consistent savings patterns and regular deposits can show financial responsibility.

Savings Record

Genuine savings usually at least 5% of the purchase price strengthens your application.

Household Contribution Evidence

If you’ve been paying board or contributing to household costs (even informally), some lenders will accept this with a statutory declaration or family letter.

Employment & Income Stability

A stable income history often carries more weight than rental history for many lenders.

At Flenley Financial Group, we:

Compare 340+ lenders to find those that don’t require rental history

Help present your savings and income evidence in the best light

Explore low deposit loans and first home buyer schemes

Structure your loan to maximise borrowing power and minimise costs

When you apply for a loan through Flenley, the lender pays us — not you.

No hidden fees. No surprises.

It’s how we do things the right way.

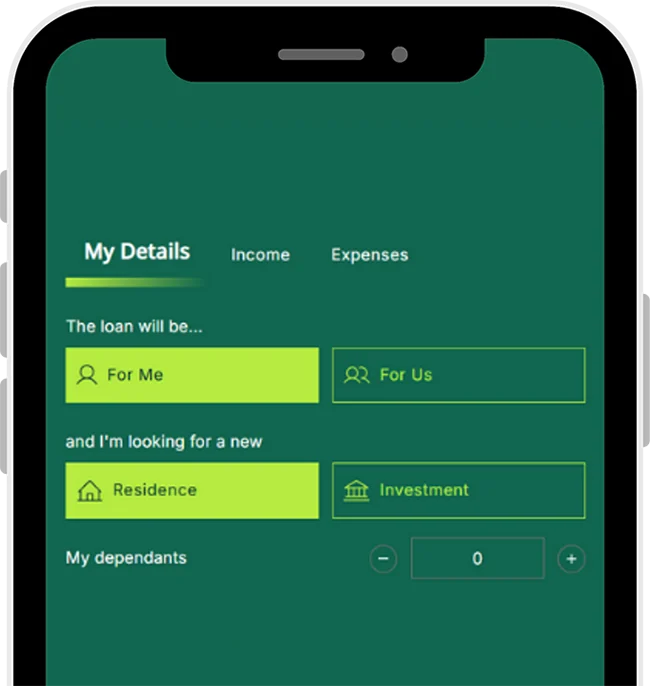

Get a quick estimate now

Estimate repayments

Check purchase costs

Calculate in 60 seconds

Redefining financial services in Australia with top-tier customer satisfaction, innovation, and comprehensive care.