Going through a divorce or separation is emotionally and financially challenging, especially when property is involved. If you shared a home or mortgage with your former partner, refinancing may be the next step toward independence.

At Flenley Financial Group, we specialise in helping people:

Yes — if you meet the lender’s criteria. To refinance the property into your name alone, lenders will assess:

If the numbers stack up, you may be able to keep the home — and move on without your ex.

If both parties agree and you can afford to take on the mortgage alone, here’s how the process works:

Get a property valuation to determine current equity

Agree on how much of that equity will go to your ex

Refinance the loan into your name, releasing their share

Update the title and legal ownership

We’ll guide you through each step, and help ensure the deal is fair and financially sustainable.

When you apply for a loan through Flenley, the lender pays us — not you.

No hidden fees. No surprises.

It’s how we do things the right way.

340+ lenders including those who support single income borrowers

Experience navigating emotional and financial complexity

Supportive, non-judgemental advice

Custom loan structuring for your fresh start

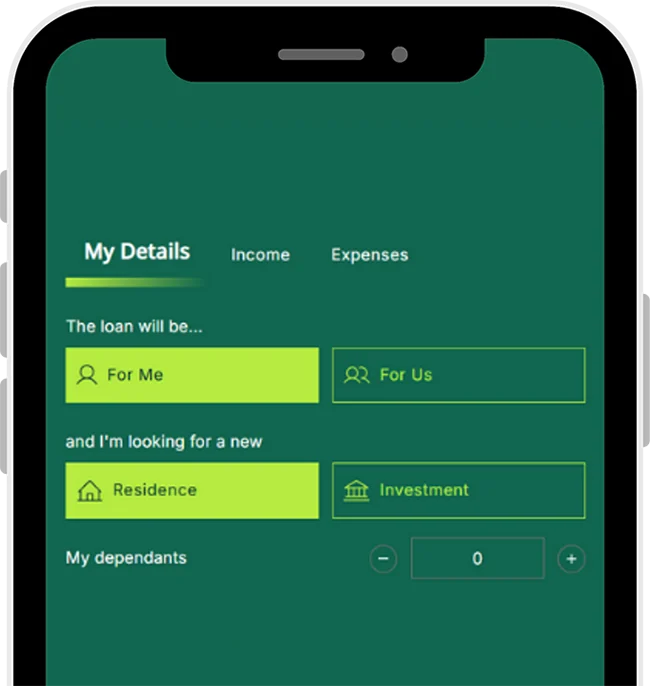

Get a quick estimate now

Estimate repayments

Check purchase costs

Calculate in 60 seconds

Redefining financial services in Australia with top-tier customer satisfaction, innovation, and comprehensive care.