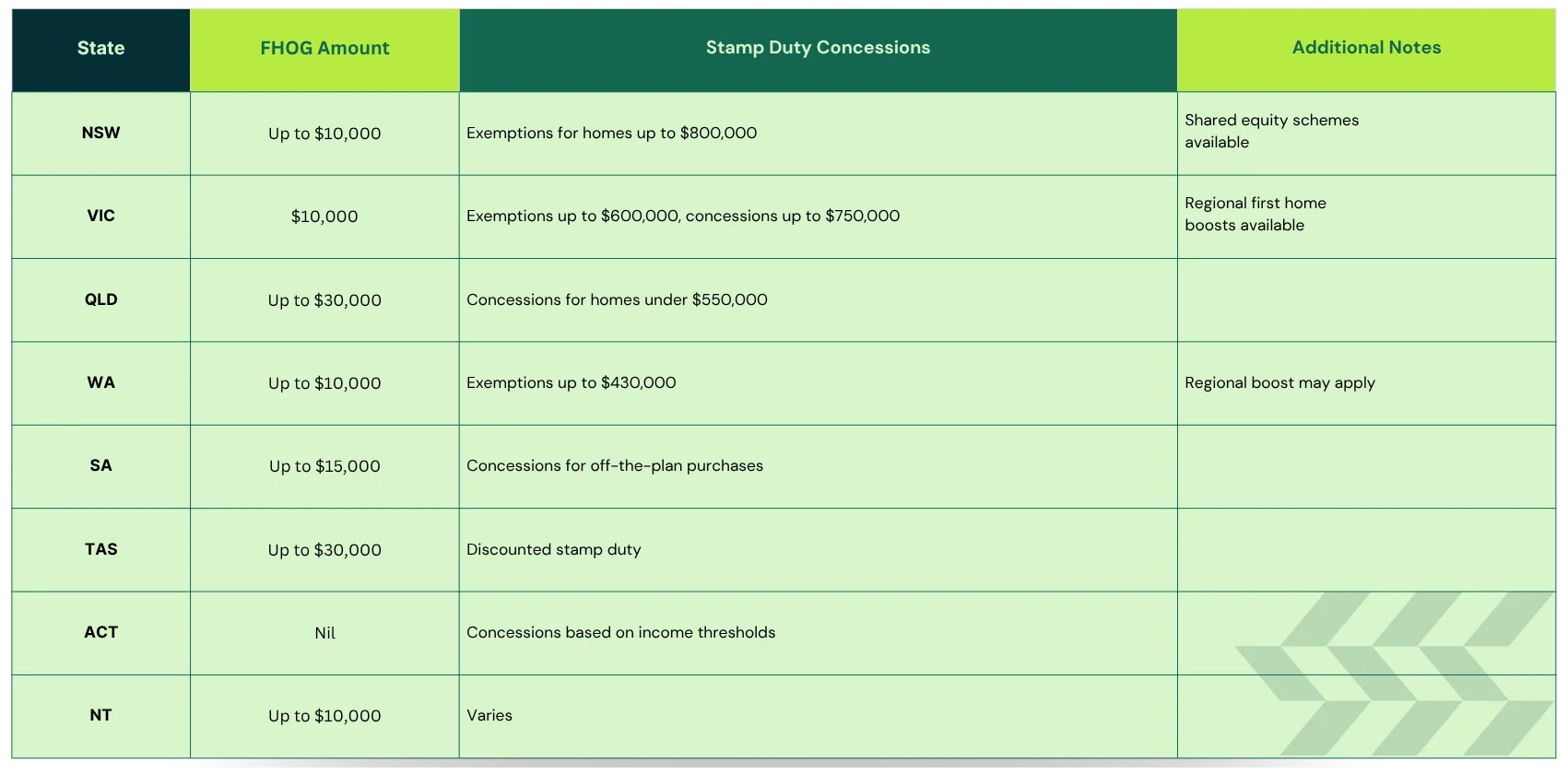

If you’re a first home buyer in Australia, you could be eligible for thousands in grants, stamp duty concessions, and government-backed loan schemes.

At Flenley Financial Group, we help first home buyers:

Beyond the paperwork, how you structure your investment loan matters.

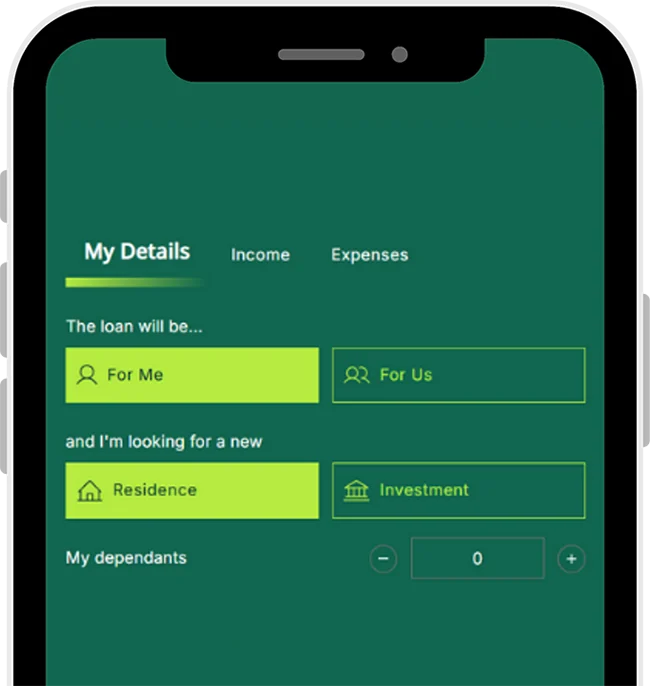

We’ll help you:

Note: Grant amounts and eligibility criteria are subject to change.

Always check the latest state government updates.

We’ve built exclusive relationships with over 340 lenders.

When you choose a loan through Flenley, the lender pays us — not you. Our commissions come directly from the bank as part of the deal. There are no hidden fees or surprises.

It’s how we do things the right way.

Grant & scheme experts. We’ll check every available option for your situation.

More lender choice. Access to 340+ lenders, including low deposit options.

Personalised advice. We tailor your loan structure and help manage grant applications.

Clear communication. No jargon. No pressure. Just smart solutions.

Get a quick estimate now

Estimate repayments

Check purchase costs

Calculate in 60 seconds