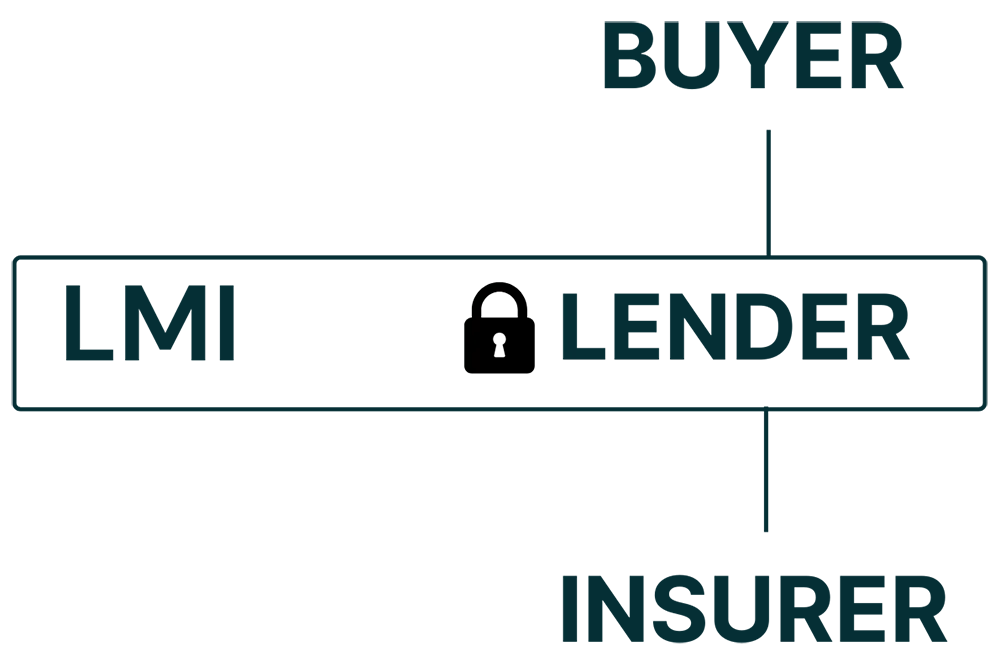

Lenders Mortgage Insurance (LMI) is a one-off insurance premium charged by lenders when your deposit is less than 20% of a property’s value.

It protects the lender — not you — if you default on your loan.

If you’re borrowing more than 80% of the property’s value (which is called a high LVR loan), you’ll typically be required to pay LMI.

LMI is most common among:

First home buyers with small deposits

Borrowers using 5–15% deposits

Applicants without a guarantor

Self-employed or casual income earners without full documentation

While it can cost thousands, LMI allows you to enter the market sooner without waiting years to save a 20% deposit.

Yes — here’s how:

Yes — in many cases, paying LMI can be smarter than waiting years to save 20%.

At Flenley Financial Group, we help you weigh up the cost of LMI vs the cost of delaying.

When you work with Flenley, the lender pays us — not you.

✔ No client fees

✔ No hidden costs

✔ Just expert advice on whether LMI is worth it for your situation

At Flenley Financial Group, we:

Access to 340+ lenders, including those with flexible LMI rules

Guidance on government schemes and LMI waivers

Expertise in low deposit lending and guarantor loans

Clear, honest advice — always tailored to your goals

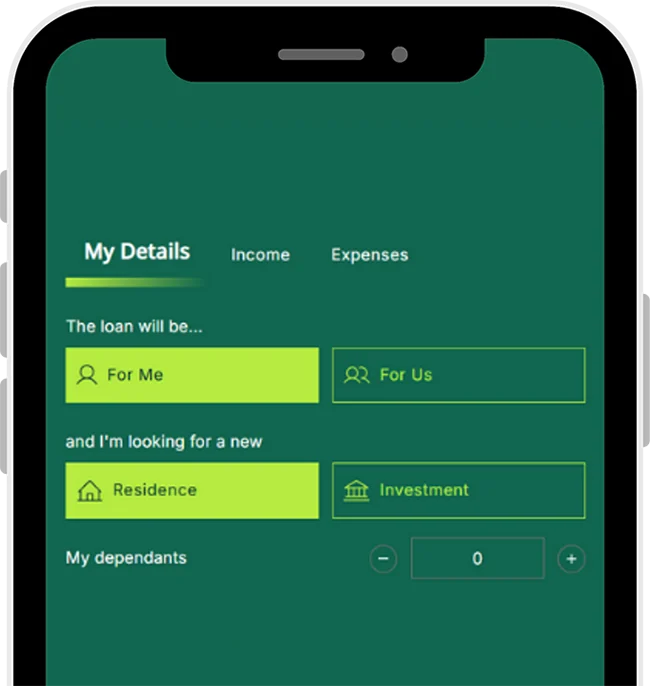

Get a quick estimate now

Estimate repayments

Check purchase costs

Calculate in 60 seconds

Or call us directly at 0461 559 105 to learn how to minimise or avoid LMI and still get into the market confidently.