A transaction account linked to your home loan. The balance reduces the amount of interest charged on your mortgage.

Lets you withdraw extra repayments you’ve made on your loan if needed. Useful for flexibility.

An interest rate locked in for a set period (usually 1–5 years). Repayments stay the same during this time.

An interest rate that can change over time. Your repayments may go up or down.

Part of your loan has a fixed rate and part has a variable rate. Offers both stability and flexibility.

For a set period, you only pay interest (not the loan principal). This can lower repayments temporarily, often used by investors.

Your repayments cover both the loan principal (amount borrowed) and the interest charged.

A single percentage figure that includes the interest rate and most fees to help compare loans more easily.

Insurance that protects the lender if you default. Usually applies if your deposit is less than 20%.

The loan amount divided by the property value. Lower LVR usually means better loan terms.

A family member or other person who offers security for your loan, helping you borrow more or avoid LMI.

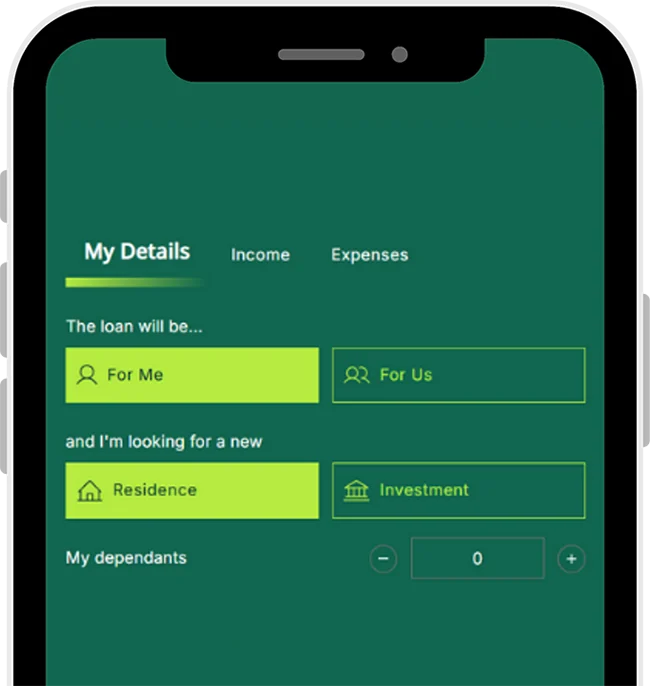

Conditional approval from a lender confirming how much you can borrow — helpful before house hunting.

Understanding loan features helps you:

We can explain how each of these applies to your situation and help you build a smart loan structure.

Get a quick estimate now

Estimate repayments

Calculate in 60 seconds

Redefining financial services in Australia with top-tier customer satisfaction, innovation, and comprehensive care.