Whether you’re buying your first home, upgrading, or investing, choosing the right loan can save you thousands and put you in control of your financial future. At Flenley Financial Group, we take the guesswork out of the process.

We’re not tied to one lender. We compare the market to find your best options.

No jargon. No hard sells. Just smart advice so you can make confident decisions.

We take the time to understand your situation and build a lending strategy that works for you — now and into the future.

Our team stays with you to review your loan regularly, so it keeps working for you.

We’ve built exclusive relationships with over 340 lenders.

When you choose a loan through Flenley, the lender pays us — not you. Our commissions come directly from the bank as part of the new loan. There are no hidden fees or surprises.

You get expert guidance, more choice, and no direct cost for our service.

It’s how we do things the right way.

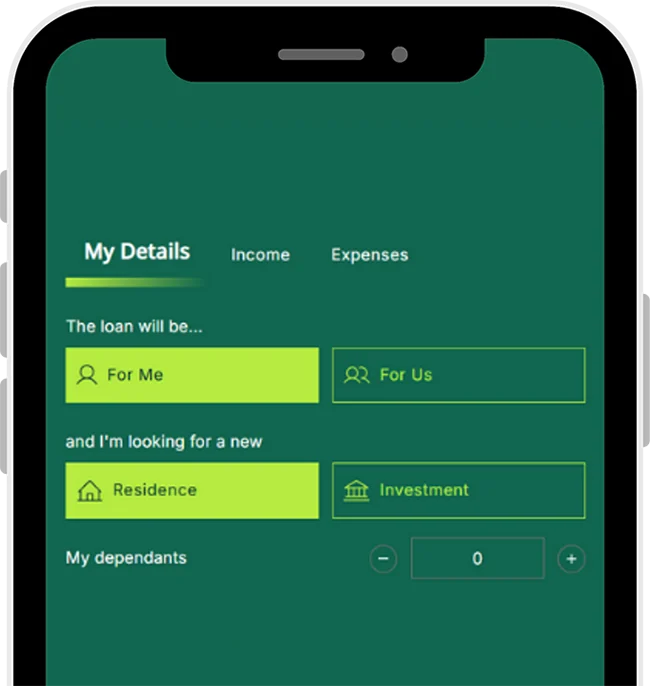

Buying your first home can feel overwhelming but it doesn’t have to be. We walk you through the entire journey with tailored advice, access to 340+ lenders, and support securing government schemes and grants. From pre-approval to settlement, we’re by your side every step of the way.

Whether you’re upsizing for a growing family or relocating to a new area, we make your next home purchase smooth and stress-free. We’ll help you unlock equity, explore bridging loans if needed, and structure your new loan to suit your lifestyle and future goals.

Smart property investment starts with the right loan. We help investors maximise borrowing power, minimise tax, and structure loans for long-term growth. Whether it’s your first investment or part of a growing portfolio, our access to over 340 lenders means better flexibility and rates.

Getting a home loan while self-employed can be complex but that’s where we shine. We understand fluctuating income, ABNs, and non-traditional documents. We’ll match you with lenders who cater to sole traders, contractors, and business owners for a smoother approval process.

If you work in a stable profession, you may be eligible for exclusive lending benefits. From reduced deposit requirements to waived LMI, we help professionals access tailored home loan solutions designed for essential workers and high-trust careers.

Guarantor home loans can help you enter the market faster and with less deposit. We guide both the buyer and guarantor through the process, explaining risks, managing documentation, and structuring your loan to allow future flexibility and release of the guarantor.

Get a quick estimate now

Check your repayments

Don’t forget upfront costs

The best way to begin is with a quick chat about your goals.

No pressure. No obligation.

Or call us directly at 0461 559 105 for immediate advice.

Redefining financial services in Australia with top-tier customer satisfaction, innovation, and comprehensive care.