An SMSF (Self-Managed Super Fund) loan lets you use your super to purchase property, giving you more control over your retirement strategy.

At Flenley Financial Group, we help SMSF trustees:

Loans for residential investment properties

Interest-only or principal & interest

Loans for commercial property purchases

Specialist lenders for SMSF borrowing

Fixed, variable, or split loan structures

We’ve built exclusive relationships with over 340 lenders.

When you choose an SMSF loan through Flenley, the lender pays us — not you.

No hidden fees. No surprises.

It’s how we do things the right way.

Wide lender access. Not all brokers have SMSF-approved lenders. We do — over 340 of them.

Expert structuring. We work closely with your financial adviser or accountant to ensure compliance and tax efficiency.

Simple, clear guidance.

SMSF loans are complex — we make the process easy to understand and manage.

Ongoing support. We’ll assist not only at settlement but throughout the life of your loan.

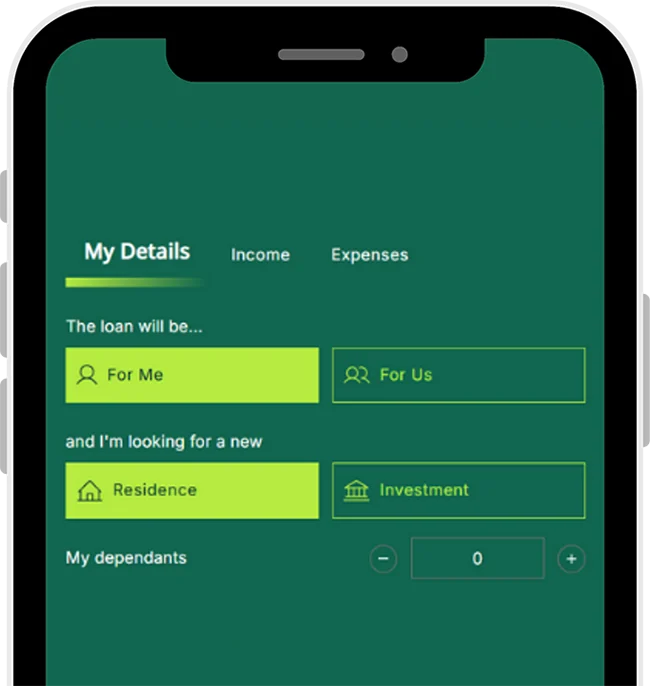

Every fund is different, but we can help you estimate borrowing capacity based on your SMSF’s balance and income strategy.

Get a quick estimate now

Check your repayments

Don’t forget upfront costs

Let’s have a no-obligation chat about your fund’s options and how to structure a smart, compliant loan.

Or call us directly at 0461 559 105 to speak with a lending specialist.

Redefining financial services in Australia with top-tier customer satisfaction, innovation, and comprehensive care.